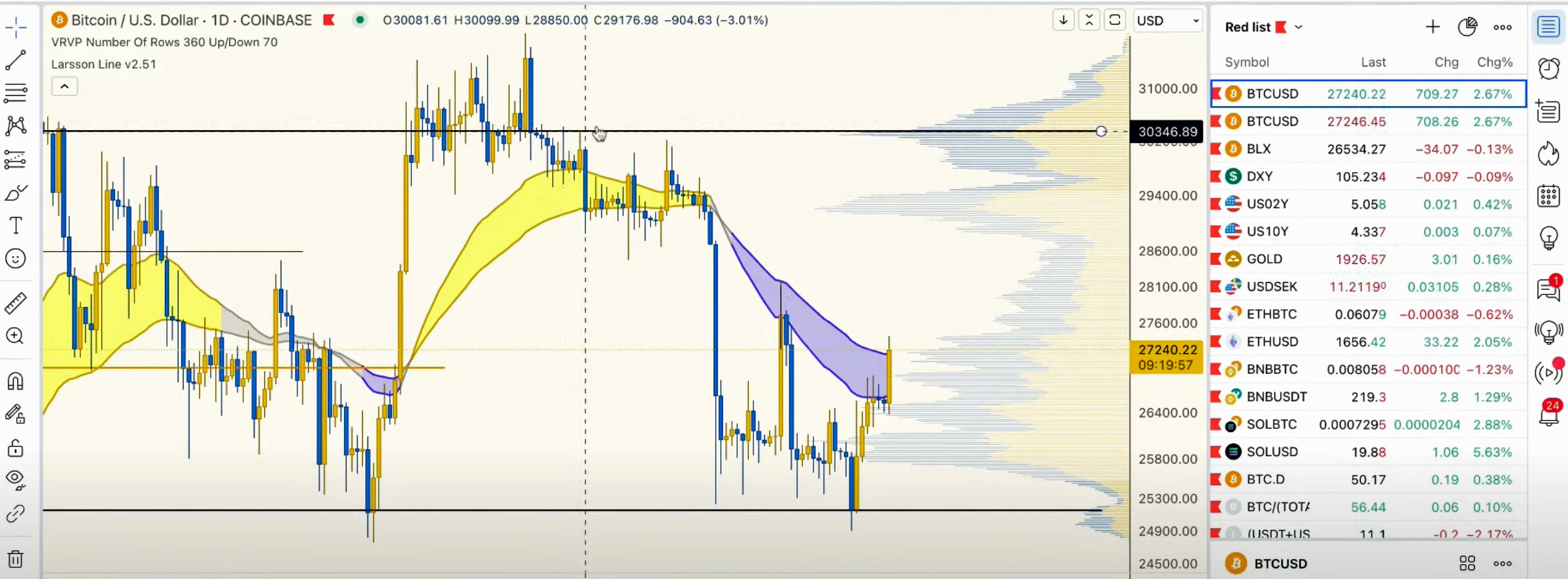

(The image above represents the current status of Bitcoin on 18 September 2023 and may not be current today).

Videos Discussing Current Digital Asset Markets?

The posts below include videos on the status of current markets in Digital Assets. They are sorted by relavent interest and not chronological date. The videos may include presentations by an individual or team — or a discussion amongst professionals in the industry. The image above represents the current status of Bitcoin on 18 September 2023 and may not be current today. NOTE: Because many of these videos are hosted on YouTube, there will be brief Ads (which may be skipped) on an intermittent basis. Moreover, some presenters promote discounts and/or products they offer for sale to support expenses involved in team research and production expenses. The main content, however, is worthy of your time.

05 DEC 23 – This market update by James at MoneyZG illustrates where we are in the Bitcoin 4-year cycle. The analysis shows the previous cycles starting in 2017 and where we are now. According to the Bitcoin charts, the previous down cycle (Bear Market) ended in November of 2022 which is considered by many the start of the next bull run of Bitcoin. The current Bitcoin chart shows an upward repricing based on the potential spot Bitcoin ETFs being approved by the SEC in the next month or so. Most pro Bitcoin analysts anticipate a continued uptrend throughout 2024 and into 2025. The video is not investment advice, but the location of the current price on the analysis chart indicates a prolonged uptrend from this point forward.

20 NOV 23 – This DCA-Live discussion includes CTO Larsson; Ivan on Tech; and James from InvestAnswers. Discussions address the effect of Bitcoin as a movement towards the return of money to the private sector and the people. They cover the profound statement of the return of money and power to the people. In their opinion, Bitcoin is the only viable neutral settlement asset network that can usher in a new global, realtime payment system. They also talked about the positive effects being seen in Argentina and El Salvador where they have adopted Bitcoin as a national currency. These countries are attracting companies and investments to stimulate (and save) the economies.

15 NOV 23 – As Chief Investment Officer and founder of Morgan Creek Capital, Mark Yusko believes that trillions of dollars is coming for Bitcoin and cryptocurrency. In his opinion, people have NO IDEA what’s coming. Firstly, the blockchain eliminates the need for trust. There is currently $7 Trillion dollars of capital making up the ‘trust’ industry, which is made up of Banks and Financial institutions. Because the blockchain is decentralised and completely transparent, there is no need for trust anymore, therefore freeing up trillions of dollars. Secondly is Reverse Greshamns law, which is a law where Good Money drives out Bad money. This scenario occurs when people have higher trust in a form of money that is perceived to be of higher quality that the alternatives.

25 OCT 23 – This DCA-Live discussion includes CTO Larsson; Ivan on Tech; and James from InvestAnswers. Discussions include comparisons of past 4-year cycles to the current cycle approaching the Bitcoin Halving which is estimated to occur in April of 2023. The unique difference of this cycle after the bottom of the bear market in cryptocurrency is the soon to be approved Spot Bitcoin ETF. Applications have been submitted by Blackrock, VanEck, Fidelity, and others. Also discussed is the anticipated financial platform proposed by Elon Musk whereby X will be a worldwide financial system where a local bank account will not be required.

25 SEP 23 – This DCA-Live discussion includes CTO Larsson; Ivan on Tech; and James from InvestAnswers. Discussions include macro factors and views on the worldwide economy; Dollar Index (DXY) which is the value of the US Dollar versus a basket of global currencies; and overall market of bond yields and markets around the world. Over all, the focus in the decrease in value of fiat money around the world.

© 2022 All Rights Reserved.