A Continuous Uptrend in Price is All That Matters

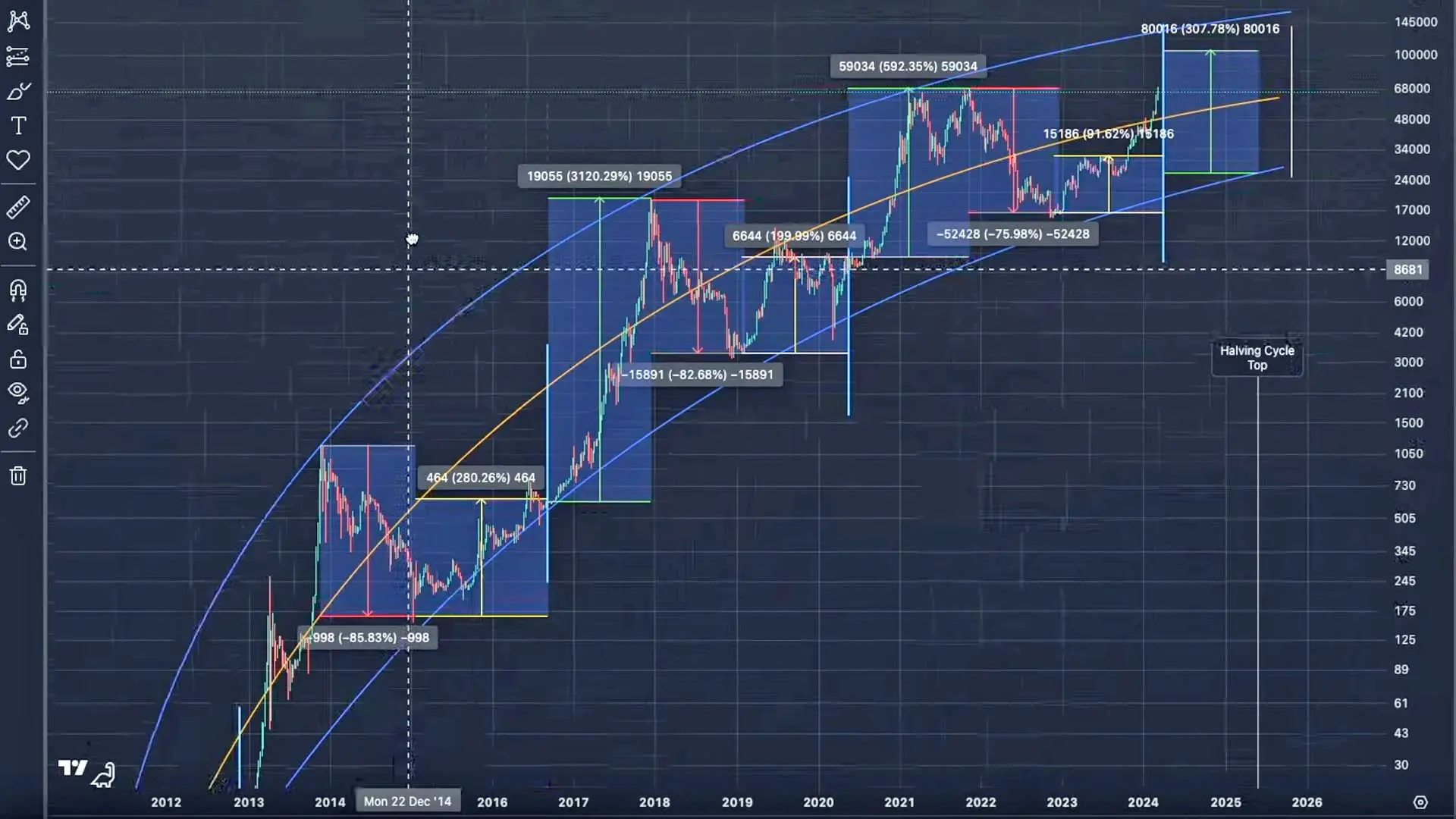

In the world of cryptocurrencies, Bitcoin stands tall as a beacon of revolution and change. It promises vast opportunities, yet is characterized by notorious bitcoin volatility. For long-term investors, the main consideration is the long-term trend. In the image above, the volatility can seem overwhelming. However, the trend is continuously up and to the right. To illustrate this further, the chart shows three lines to define the trend. The upper and lower lines correlate to the tops and bottoms of the cyclical movement. The center line shows the median price between the upper and lower lines. As you can see, the median price is always up and to the right, which means the median price continues to rise — even though the journey is volatile.

Bitcoin Volatility Reductions on the Horizon

There are several reasons why Bitcoin volatility should be reduced in the upcoming years. The main reason is the increased demand for Bitcoin and the upcoming lack of supply. The recent approval of Spot Bitcoin ETFs (Exchange Traded Funds) by the Securities Exchange Commission (SEC) has stimulated the demand for Bitcoin. Whereas Bitcoin demand was previously driven by retail investors and speculators, the demand now is driven by institutional investors. This means that corporations, pension funds, and individual retirement account holders now have the opportunity to invest in Bitcoin. As a result, investment time horizons for the new investors are much longer than short term speculators. Thus, volatility should be reduced as more institutional investors come on board.

Longer Term Investors

As more long-term investors enter the market, the available supply of Bitcoin will dwindle, making it more scarce. Simply put, demand will surpass supply. This is due to the fact that only 21 million Bitcoin will ever exist and this will lead to increasing scarcity. Since the launch of Bitcoin in 2009, over 19 million Bitcoin have already been minted. With increasing demand and a finite supply, Bitcoin price volatility ought to decrease. This implies that the median price is likely to sustain an indefinite upward trend once the supply becomes limited. An intriguing point to note is that an estimated 5 million BTC has been lost due to asset mismanagement and this can also impact the overall price and availability of Bitcoin.

Understanding 4-Year Cycles

Although Bitcoin has experienced 4-Year price cycles since its inception in 2009, prices peaked at the end of 2013, 2017 and 2021. Following each of these events were two years of bear markets before rising again to all time highs in prices. Interestingly, the 4-year cycles of Bitcoin seem to coincide with other 4-year patterns like:

- National Elections

- Interest Rate Cycles Created by the Federal Reserve

- Government Spending

- Excess Printing of Money

- Business Cycles and Macro Economic

- Bitcoin “Halving”

Thus, the 4-year cycles of Bitcoin are well connected to other international and worldwide events. The Bitcoin Halving event is a different matter and related directly to Bitcoin.

What is Bitcoin Halving?

The Bitcoin blockchain is the foundation of the Bitcoin cryptocurrency. It’s essentially a giant public ledger that records every single Bitcoin transaction ever made. Unlike traditional financial systems where a central authority controls the recording and accuracy of transactions, the Bitcoin blockchain is a distributed ledger. This means copies of the ledger are distributed across a vast network of computers around the world.

Blocks and Miners

Because the blockchain is decentralized, and not controlled by anyone, it needs an independent system to verify and validate all transactions on the blockchain. To do so, the blockchain is made up of individual blocks that are awarded to a blockchain miner, a term that draws a parallel to the process of mining for gold. Bitcoin Miners are companies with special computers that compete to solve complex mathematical puzzles to verify transactions and add new blocks to the chain. As a reward for their work, miners receive a certain number of Bitcoins. This process is called mining and is what creates new Bitcoins.

Impact on Supply

Bitcoin halving, also known as the “halvening,” is a significant event built into the Bitcoin blockchain that reduces the block reward for miners by half roughly every four years. The next halving event should occur on or about 17 April 2024 and will cut the block reward in half. For example, the current reward is 6.25 Bitcoins and it will be reduced to 3.125 Bitcoins after the halving.

Scarcity Effect

In theory, with the supply of new coins decreasing but demand potentially remaining constant or increasing, the halving can create a scarcity effect. Similar to other scarce assets, Bitcoin’s price could potentially rise due to this perceived scarcity. Currently, around 900 Bitcoins are being mined daily, whereas exchange-traded funds are acquiring an average of 3,000 Bitcoins per day. After the next halving in April, this amount mined daily will be reduced to 450 Bitcoin. Contemplating the future Bitcoin price is intriguing considering the production of only 450 BTC daily against a demand exceeding 3,000 per day.

ETFs — A Gateway to Less Volatility

Bitcoin ETFs offer investors a novel way to participate in Bitcoin’s potential without directly owning the asset, thereby mitigating volatility. By investing collectively, individuals reduce their vulnerability to the unpredictable shifts of cryptocurrency markets, aiming for steady growth without the usual turbulence. For further details on Exchange Traded Funds and their relationship with the “Spot” Bitcoin price, click here.

Conclusion

For both short-term and long-term investors, amidst market volatility, the fundamental factors of supply and demand remain pivotal. In the case of Bitcoin, the future indicates a surge in demand coupled with limited supply. Hence, the value of Bitcoin could rise as a result of its anticipated scarcity.

Share Buttons (Share on Your Own Social Media Account).

© 2022 All Rights Reserved.