Brief Educational Videos on Cryptocurrency and Other Digital Asset?

These posts includes educational videos that may help in understanding the Digital Asset Universe. Guy from the Coinbureau is one of my favorite researchers in this area and his presentations are unique and professional. Other presenters are included in this section based on their application to education in digital assets. (Click on the image caption to watch the video on YouTube or click on the paragraph link to watch the video on Guy’s website.)

NOTE: Because many of these videos are hosted on YouTube, there will be brief Ads (which may be skipped) on an intermittent basis. Moreover, some presenters promote discounts and/or products they offer for sale to support expenses involved in team research and video production expenses. The main content, however, is worthy of your time.

Consequences of a Centralized Cashless Society – This video discusses the consequences of a centralized (dystopian) cashless system and compares it to a more utopian de-centralized cashless system.

This 10-minute video is not part of the Coinbureau Video series, but it is a great introduction to cryptocurrency from a beginner’s point of view. The first part of the video describes our current “centralized” banking and payment systems and the new “de-centralized” systems. This is now possible because of the development of a worldwide blockchain that is not owned by any large corporation or government. The second part of this video explains the difference between Web1, Web2, and the new Web3 that is being developed.

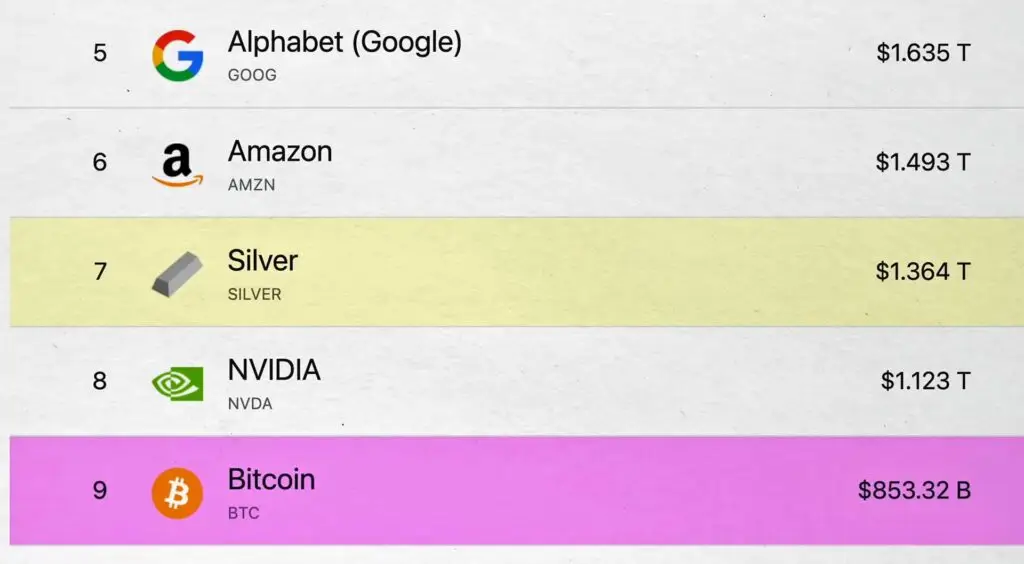

This 14-minute video shows Bitcoin is now the 9th largest asset class in the world. The first four asset classes where: Gold, Apple, Microsoft, and Saudi Aramco. Meta Platforms, Berkshire Hathaway, and Tesla were the next three after Bitcoin. It also illustrates how inflation can affect the prices of all asset classes. As an example, the price of Bitcoin at it’s previous all-time high in November of 2021 was $68,789.63. Based on inflation, the price of Bitcoin in December of 2023 (not withstanding market fluctuations) would be $76,145.81. So, what could be the value of Bitcoin in 2024? Watch this video to understand all the forces at play.

What is Web3? This video by Casey gives a great overview of What Web3 is by first explaining Web1 and Web2. Her presentation is easily understood by beginners who would like to know more about the next phase of technology around the world. She also discusses topics like: Tokenization in Web3; Investment Opportunities in Web3; Predictions for Web3; the Metaverse and Non-Fungible Tokens (NFTs) in Web3; and how the middle class will have equal opportunities for advancement in the digital asset world..

Cryptocurrency was born out of the 2008 Financial Crisis. It was a reaction to the misconduct of government and financial institutions who made bad policy decisions and increased the printing of paper money without a gold standard in reserve. This in turn caused continuation of the debasement of the U.S. Dollar, and thus, a decrease in its purchasing power. At first, cryptocurrency was misunderstood and was a joke to the government and U.S. Banking institutions. Now that crypto is increasing in adoption around the world, the federal government feels threatened by the competition of crypto and they are trying to create a Central Bank Digital Currency (CBDC) to keep control of the spending habits of its U.S. citizens. This video presents a comparison of CBDCs and Cryptocurrency.

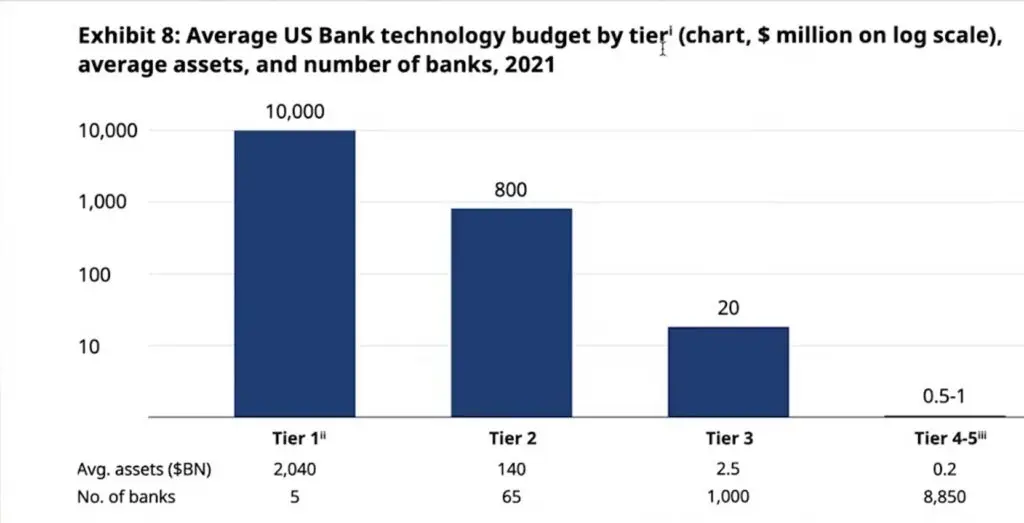

This video discusses Why All Banks Will Be Forced To Use Digital Assets Soon. The presenter talks at a very fast pace in this video, but it shares why banks will be provide cryptocurrency and other digital assets to its existing depositors very soon. A survey was made back in 2021 this is a 2022 document but they did a survey in 2021 and they surveyed 2,000 people and the survey said that if my bank off offered me crypto that I would be more inclined to buy and hold it with my bank right the survey said that if they use those numbers and go out into the entire United States adult population 45 to 65 million people in the United States would own cryptocurrency if they could buy through their bank.

.

Banks Worried About Crypto – (The beginning and ending sections are the most interesting. It gets a little technical in the middle.)

This video discusses Why Banks are Worried about Cryptocurrency and why cryptocurrency represents a threat to international banking and Central Bank business models. Some of you will know JP Morgan’s CEO Jamie Dimon is famous for being anti-crypto — and he’s been vocal in his opposition since crypto went mainstream in 2017. He once called cryptocurrencies “decentralized Ponzi schemes”. Earlier this month, however, JP Morgan published a report analyzing the Crypto Market in the United States and the findings in the report could shed light on what will happen in the crypto Market in 2023. The report begins with a short introduction which gives an overview of crypto adoption in the United States. The authors reveal that almost 15 percent of the US population has used or invested in crypto. The authors also said their data sample includes over 5 million of JPM’s customers and over 600 000 of them made transactions related to crypto. The concern for many banks is that many deposits in traditional banking will be reduced as bank customers withdraw funds to participate in cryptocurrencies. And they see this as a threat.

This video discusses Central Banks BUYING Bitcoin? The Clearest Sign Yet!. Earlier in December the Bank for International Settlements, or BIS, released standards that will allow central banks around the world to start holding cryptocurrency on their balance sheets. This is unprecedented because the BIS and Central Banks have long been vocally opposed to cryptocurrencies.

© 2022 All Rights Reserved.