Digital Asset Tax Issues

The two main issues discussed in this section are why anyone would donate digital assets to a church or other non-profit organization (see Donor Tax Strategies below) and digital asset adoption. Much of the information here was taken from an article written by Finoa. Finoa is a regulated custodian that was founded in Germany in 2018. It offers institutional digital asset custody for venture capital firms, crypto hedge funds, corporate and high-net-worth individuals.

Donor Tax Strategies

Here are a few strategies that can help donors lower their cryptocurrency taxes.

- Give cryptocurrency donations to registered charities

- Use tax loss harvesting to offset capital gains and income

- Hold your assets for the long-term to take advantage of lower tax rates

- Buy cryptocurrency in a self-directed IRA

- Take profits from cryptocurrency in a low-income year

.

Crypto Adoption

Global Crypto Adoption

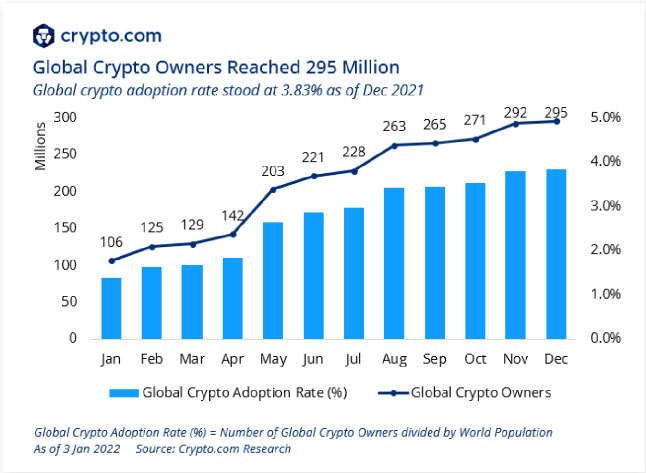

Based on research by crypto.com, global crypto owners reached 295 Million. According to Finoa, Over 10% of global Internet users likely own some form of cryptocurrency – 500m people if we assume 5 billion internet users. Crypto.com estimates closer to 300m crypto owners worldwide, a 275% increase from their January figure.

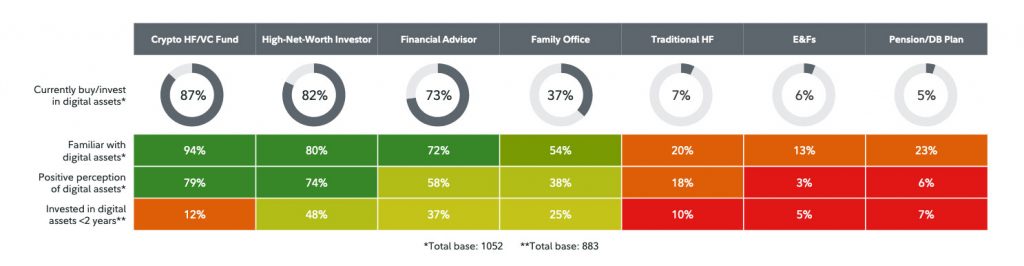

According to Fidelity: Institutional investors surveyed report that the features of digital assets they find most appealing are the high potential upside, innovative tech play, and enablement of decentralization. The image below illustrates their breakdown by category of potential digital asset interest. On a personal note, I have found that education is key in digital asset ownership. Most people I talk with are extremely biased because of the uneducated media and traditional banks who find cryptocurrency a major threat to their business plans and operating systems. As stated above, “Decentralization” is one of the most appealing features found with digital assets. Traditional banks, on the other hand, are the epitome of centralization. As an example, traditional banks work on a “Fractional Reserve” system. Stating this in a different way, banks lend money out to clients and have only a fractional amount of that loan in reserves at the bank. Although the central banking system offers FDIC insurance, it is still possible to have a “bank run” with traditional banks because they don’t have 100% reserves for all outstanding loans.

Financial Advisors

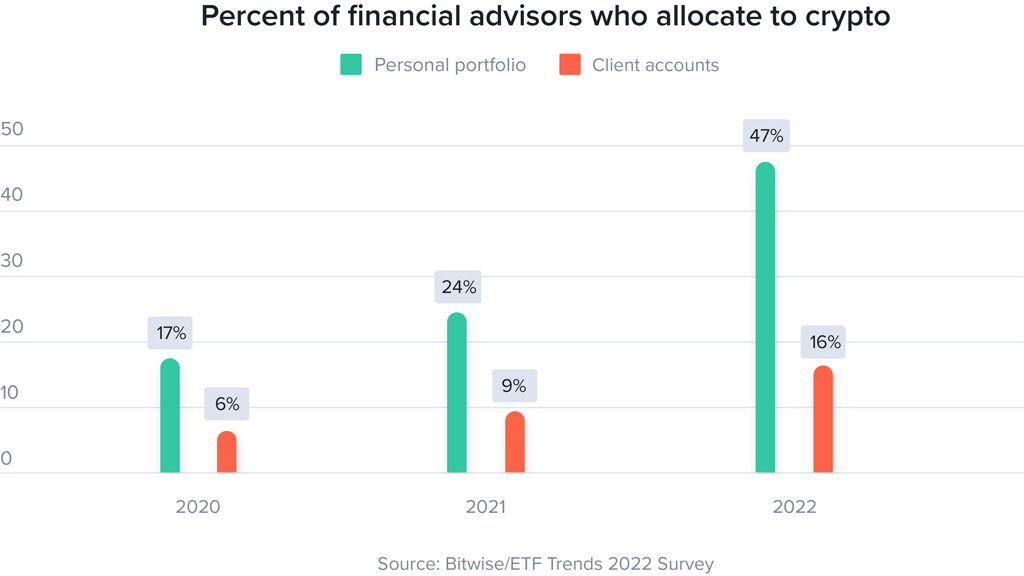

According to Finoa, crypto assets are becoming popular with financial advisors. According to Bitwise, more than 9 in 10 financial advisors received questions from clients about digital assets in 2021. Moreover 16% of advisors had allocated their clients to crypto. Almost half of financial advisors own digital assets In their personal portfolios. The strong growth year over year is shown in the adjacent graph.

Crypto Adoption Curve

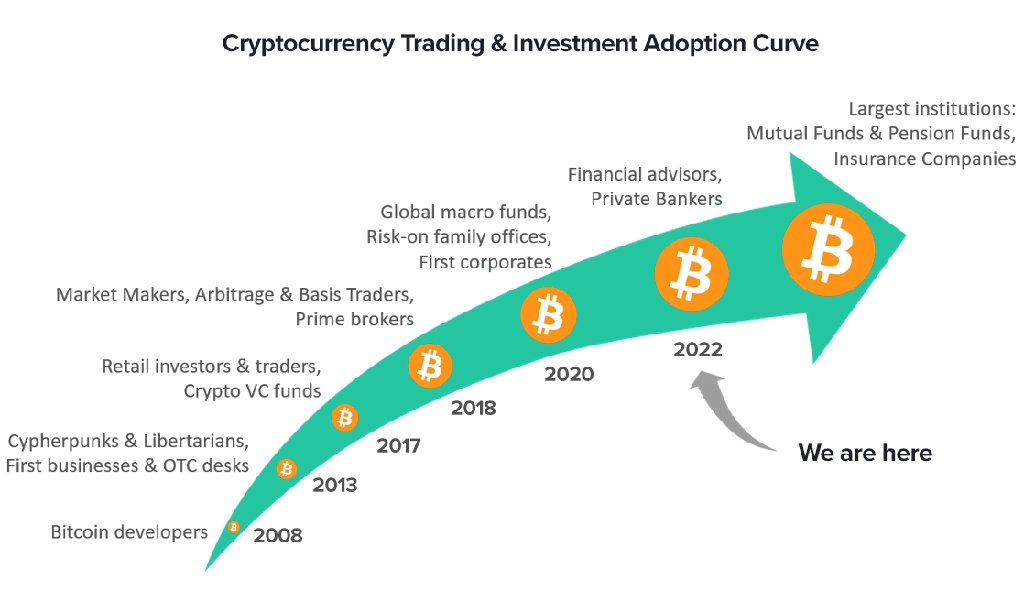

According to Finoa, A good indicator of the progress of crypto toward mainstream adoption is the so-called “crypto adoption curve.” The curve shows the different user segments, ranging from early adopters (Bitcoin developers) to the laggards, represented by large, established institutions, such as Mutual and Pension funds..

Digital Asset Tax Issues

Commodity or Security?

The jury is still out and waiting for the Securities and Exchange Commission (SEC) and Commodities Exchange to determine the status of all digital assets. At this time, it is most likely that Bitcoin will be classified as a commodity and all other alternate coins (including Ethereum) are subject to being classified as securities. According to Finoa, while crypto ownership has increased in popularity amongst investors, many hurdles remain to boost investor confidence. 37.1% of the respondents also stated that the uncertain regulatory environment is holding them back. In another analysis by Bitwise dating from January 2022, 60% of respondents cited regulatory concerns as preventing them from investing in crypto assets. At this time, it is anticipated that the newly elected congress in the United States will call for new regulations in 2023.

Value Discussions

It’s up to each Digital Asset Committee of a non-profit organization to determine the value of receiving digital assets as donations. The value of digital assets vary constantly and they act like other equity assets; i.e. there are bull and bear markets. However, the main point here is that all digital assets have a specific value at a specific time. Thus, when received as a donation, each non-profit can quickly convert the donated digital asset to local fiat currency, and at that point, the value of that donation will have a specific value and will not vary.

Tax Discussions

Although non-profit organizations are not focused on taxation, it is important to understand issues facing digital asset donors. As an example, most digital asset donations most likely will occur in the last month of taxation year… especially in down-market years. See below for donor tax strategies.

The above information might be of interest to organization leadership or Digital Asset Committees. It may help in understanding the mindset of the digital asset donor.

Donation Options

Receive Cash

There is no obligation for any Non-Profit Organization to receive digital assets as donations. Sadly, this decision will cause the organization to reduce their donation potential if digital assets are not considered as donations. We anticipate that in time, this attitude will change and the leadership will want more information.

Crypto & Cash

Non-Profit Organizations that do prepare systems to receive digital assets will increase their donation potential over time. Based on the above information, there is an increase in global adoption and as such, digital asset donations should increase over time. This system is meant to supplement traditional fiat currency donations.

Receive Less

In the event a Non-Profit Organization decides not to set up a system to accept digital currency as donations, and they rely solely on receiving fiat currency (paper money) it is extremely likely that this organization in the future will receive fewer donations than those accepting both digital assets and paper money.

© 2022 All Rights Reserved.