Step-by-Step Instructions for Setting Up an Account

This the first in a series of articles to demonstrate how to buy a Bitcoin ETF (Exchange Traded Fund). This is not investment advice but is educational in nature. After you have done your own research and decided that a Bitcoin ETF is an asset that meets your investment objectives, these instructions can be helpful in opening or setting up your investment account. We have started with Fidelity and future articles may include different companies that offer Bitcoin ETFs. Click Here if you would like more information on understanding ETFs.

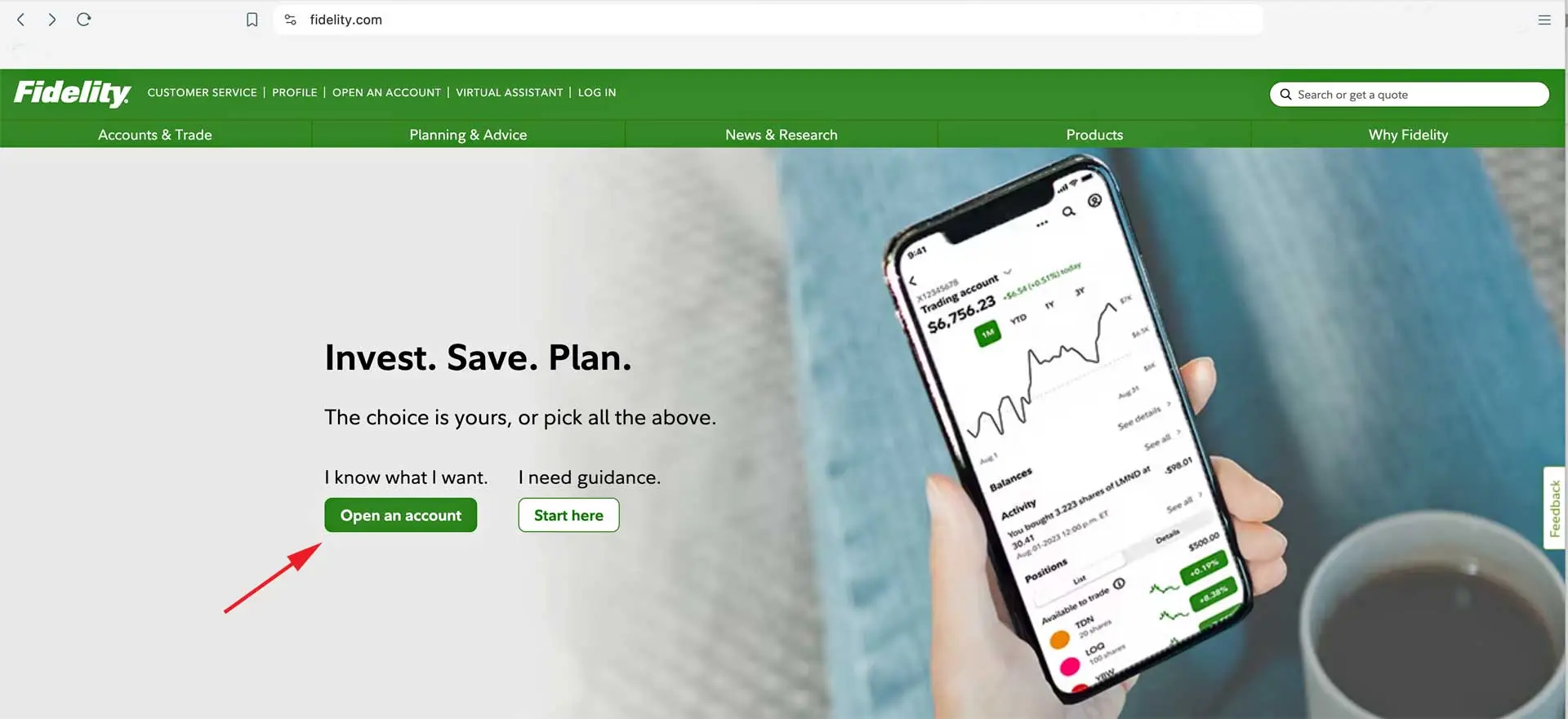

The image above show the link to fidelity.com. When you arrive at this website address, you can either “Log In” to your account if you have already have one, or you can “Open an Account” by clicking on the green button indicated by the red arrow above.

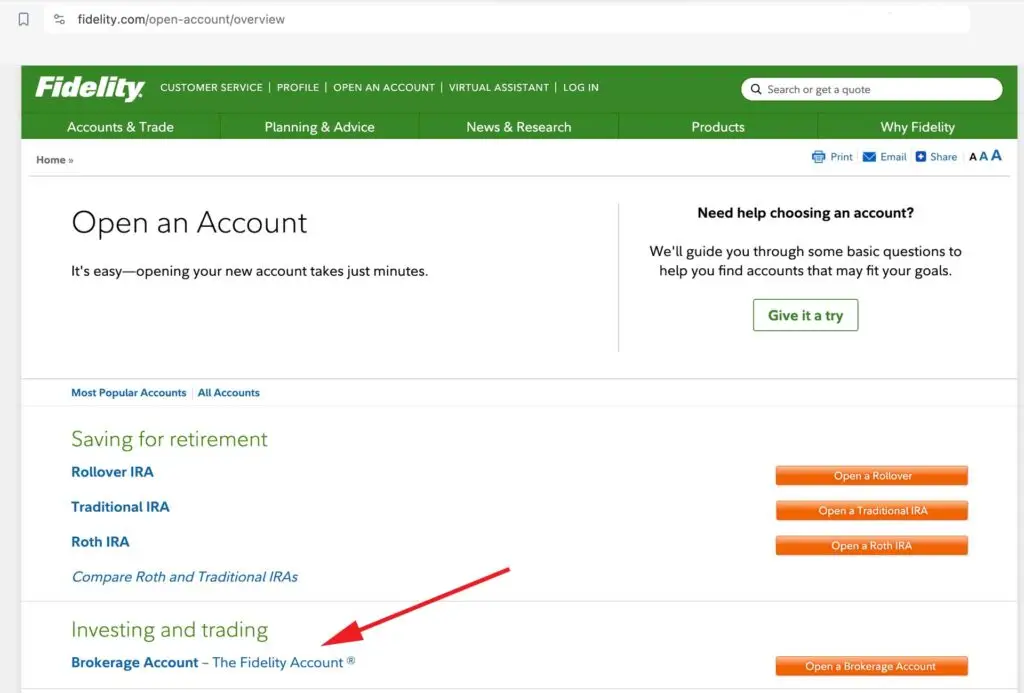

Chose Account Type

After clicking on Open an Account, you will need to select the Brokerage Account option under “Investing and trading”. This is signified by the Red Arrow in the image below.

As a side note, you do not need to open a Fidelity Crypto account under Crypto Trading. This is because the Bitcoin ETF is not part of the crypto ecosystem. For clarification, the correlation between the actual BTC price and the value of Spot Bitcoin ETF is intrinsically linked. Spot Bitcoin ETFs, by design, aim to track the market price of Bitcoin directly, meaning their value is a reflection of Bitcoin’s current market price. Stating this in a different way, owning a Bitcoin ETF is different than owning Bitcoin directly. The main point here is that you want to open a Brokerage Account for traditional equity assets and not a Fidelity Crypto account. After opening your Brokerage Account, you can always open another account for crypto trading, but that is not necessary at this time.

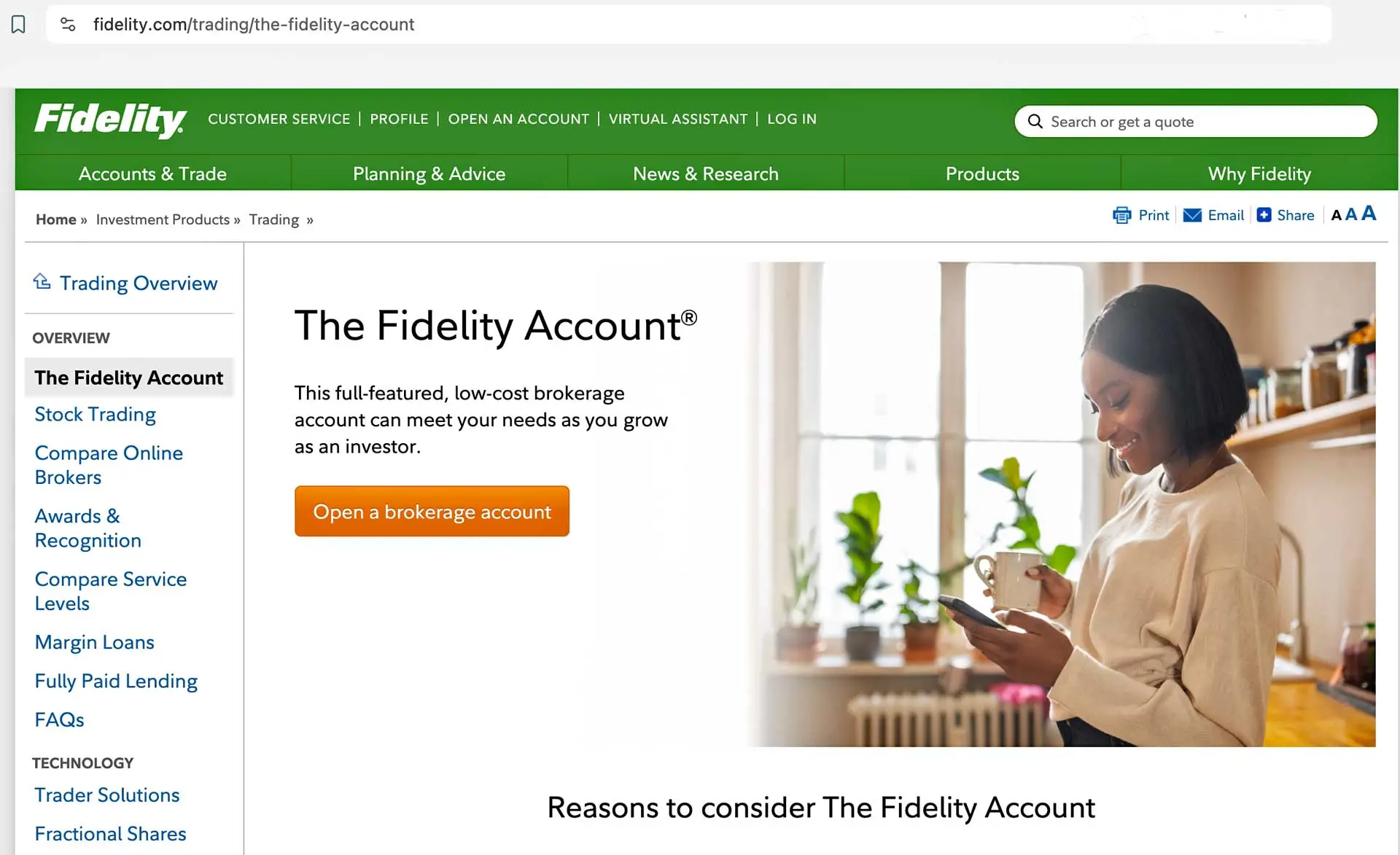

The Fidelity Account

The page below appears after clicking on the “Open a Brokerage Account” button, and it appears redundant. I am not really sure why this page comes up, but maybe it’s for marketing purposes and “Reasons to consider The Fidelity Account”. At any rate, simply click on the “Open a brokerage account” button (again) to continue the process.

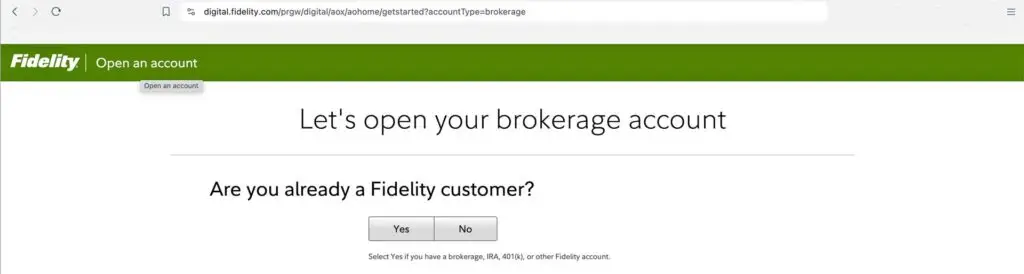

I think the page below is meant to clarify that you do not already have an account setup at Fidelity. So, click on “No” to set up the account.

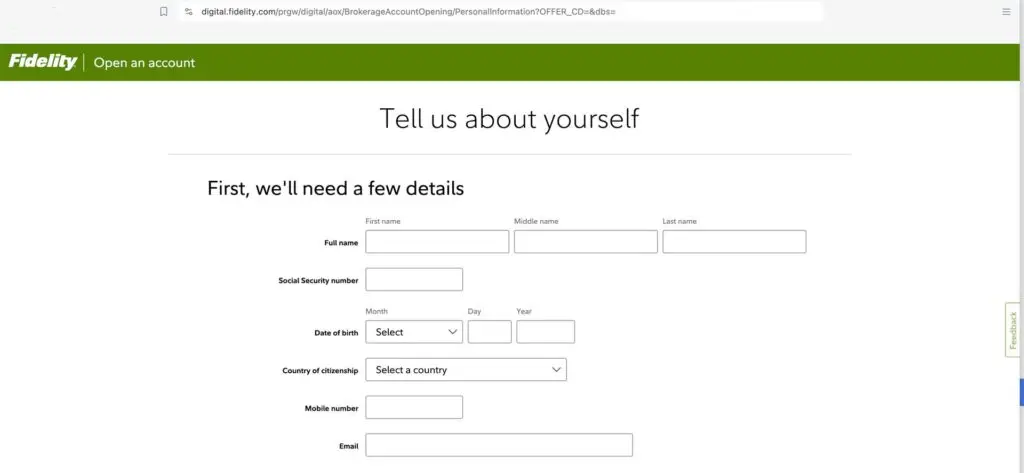

The page below is just a list of things Fidelity would like to know about you before they approve and verify the account. Simply fill in the information and click on “Next”.

Submit the Account Application

Once all the requested information has been filled in, click on the next button. If you have any questions about the forms, simply chat online with a Fidelity representative, or call them at their toll free number.

Link or Connect Your Personal Bank Account

Once the Fidelity Brokerage account has been approved and verified, you can deposit funds for future investments. This is done by linking your personal bank account to your new Fidelity account. This is so weekly or monthly deposits can be made to reach your investment and/or savings objectives. There is no sense leaving money sit idle in you bank account where is no return on investment or interest earned.

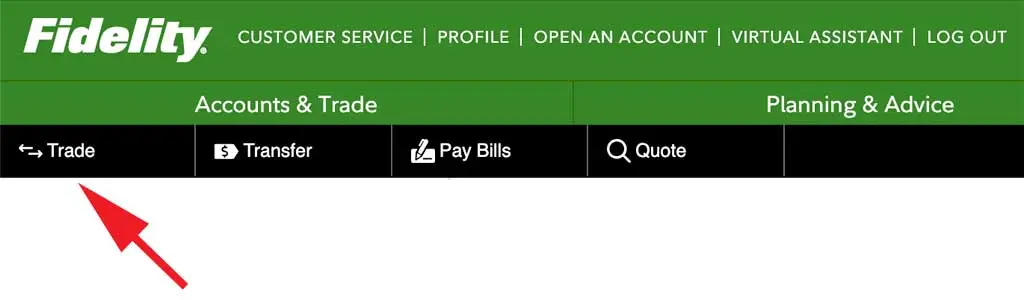

How to Buy FBTC: Fidelity Bitcoin ETF

Once you have opened your account at Fidelity and funded the account with your linked personal bank account, you are now ready to buy FBTC. On you account webpage, you will see the “Trade” option on the menu bar which is indicated by the Red Arrow. When you click on that, a new box appears with information needed to make a trade (Cash for FBTC).

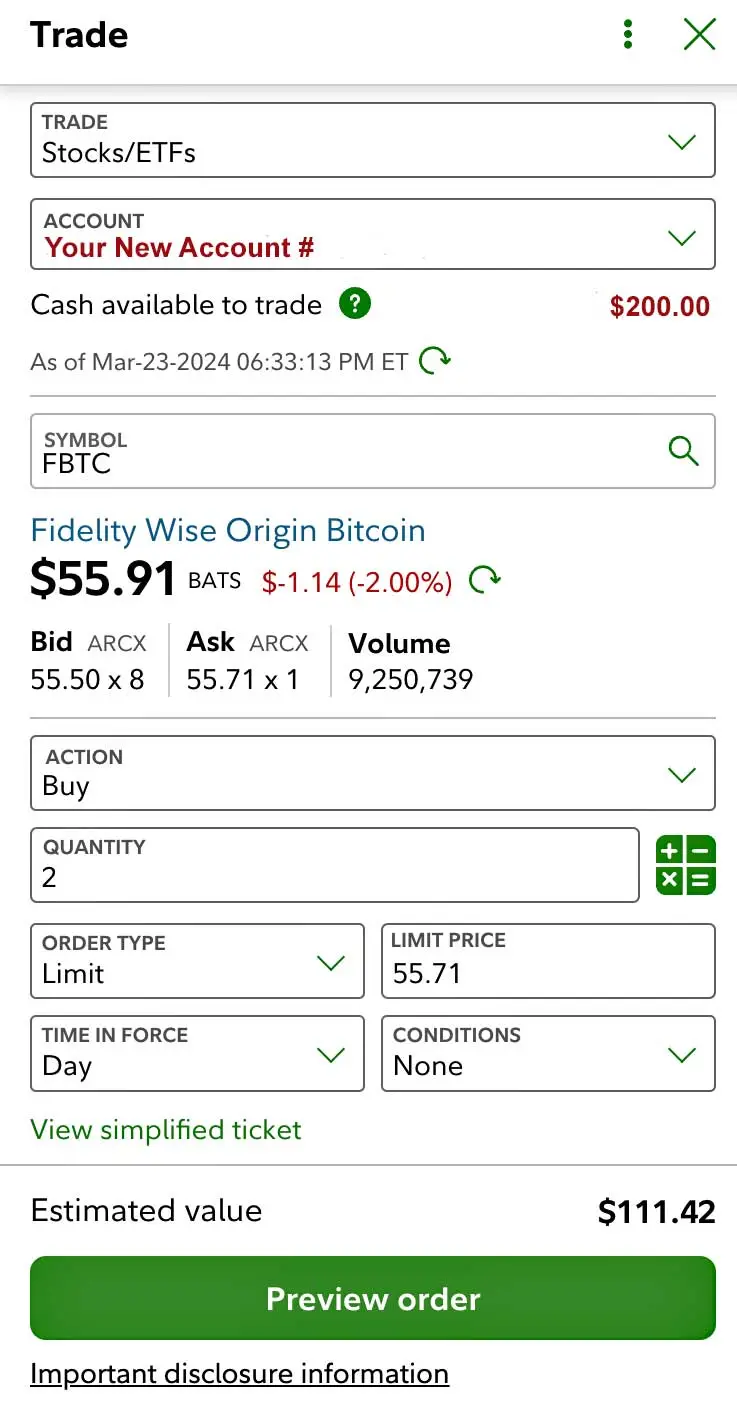

In this example, you transferred $200.00 from your personal bank account to your cash account at Fidelity. Now, your are interested in buying FBTC. Just below Fidelity Wise Origin Bitcoin (Symbol FBTC) you will see what is occurring in the market at that instant. Thus, as of Mar-23-2024 at 06:33:13 PM Eastern Standard Time someone was bidding $55.50 for one share of the FBTC ETF. At the same time, someone else was willing to sell shares at $55.71, which is higher than the price a buyer is willing to pay at that time.

So, you now have three choices:

- Place a “Market Order” and pay a price determined by the existing market (which may be higher than the price you are willing to pay).

- Place a “Limit Order” mid way between the Bid and Ask price in hopes of getting your 2 shares at an acceptable price.

- Place a “Limit Order” at the current Ask price.

In this case, we simply put in a Limit Order at the asking price to increase our chances of getting our two shares of FBTC. In a volatile market, the Ask price could be in an uptrend which means your bid price may immediately be out of date and the offer too low to be accepted.

This all may be a bit confusing, but with practice you will soon get the hang of it. As stated above, you can always change the Order Type to “Market” and be done with it. Once your Bid price is accepted, 2 new shares of FBTC will be added to your account. At the same time, your available cash will be reduced by a similar amount — less some minor trading fees. It’s actually fun to watch when you get the hang of it.

Fidelity Checking Account & Debit Card

Many clients also maintain checking accounts with Fidelity. A matching Debit Card can also be included. This is a nice feature because payments and bills can be paid out of the account. Moreover, if any money is left over in your cash account on a weekly or monthly basis, more money can be saved or invested in: traditional stocks, money market funds, or Bitcoin ETFs.

NOTE: Although you can trade Bitcoin “direct” in the cryptocurrency ecosystem 24 hours a day and 7 days a week, buying a spot Bitcoin ETF, which represents Bitcoin, is available only during normal business hours of the New York Stock Exchange. This is Monday through Friday between 9:30 am and 4:00 pm EST.

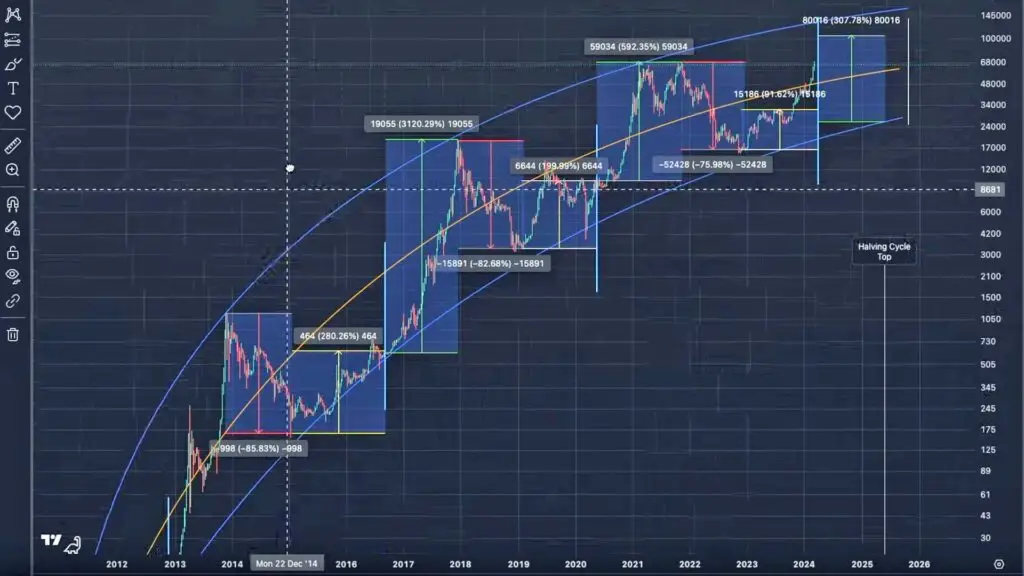

Bitcoin Volatility & Price Trend

Bitcoin promises vast opportunities, yet is characterized by notorious volatility. For long-term investors, the main consideration is the long-term trend. In this image, the volatility can seem overwhelming, but the trend is continuously up and to the right. For more information about Bitcoin volatility and price trends, Click Here.

Bitcoin Halving

Bitcoin halving, also known as the “halvening,” is a significant event built into the Bitcoin blockchain that reduces the block reward for miners by half roughly every four years. The next halving event should occur on or about 19 April 2024 and will cut the block reward in half. For example, the current reward is 6.25 Bitcoins and it will be reduced to 3.125 Bitcoins after the halving. Historically, Bitcoin prices after halving events tend to go up because there is increased demand for Bitcoin, but at the same time, the Bitcoin supply is being reduced. For more information on Bitcoin Halving, Click Here.

Conclusion

Based on the recent government approval of the spot Bitcoin ETFs, and the upcoming Bitcoin halving in April, it is thought by many that the next 12 to 18 months can cause appreciation in the Bitcoin price. As always, however, it is recommended that you do your own research. An approach taken by many savers and investors is to make deposits into an investment account on a monthly or weekly basis. This is referred to as “Dollar Cost Averaging” and over time can build up a nice safety net. In the Bitcoin ETF, for example, a goal might be to purchase 1 share every week or month. At today’s price, that would equate to just over $50 per month or week. Over time, you could be amazed on how much extra wealth you have accumulated.

Share Buttons (Share on Your Own Social Media Account).

© 2022 All Rights Reserved.