Why Digital Assets Matter

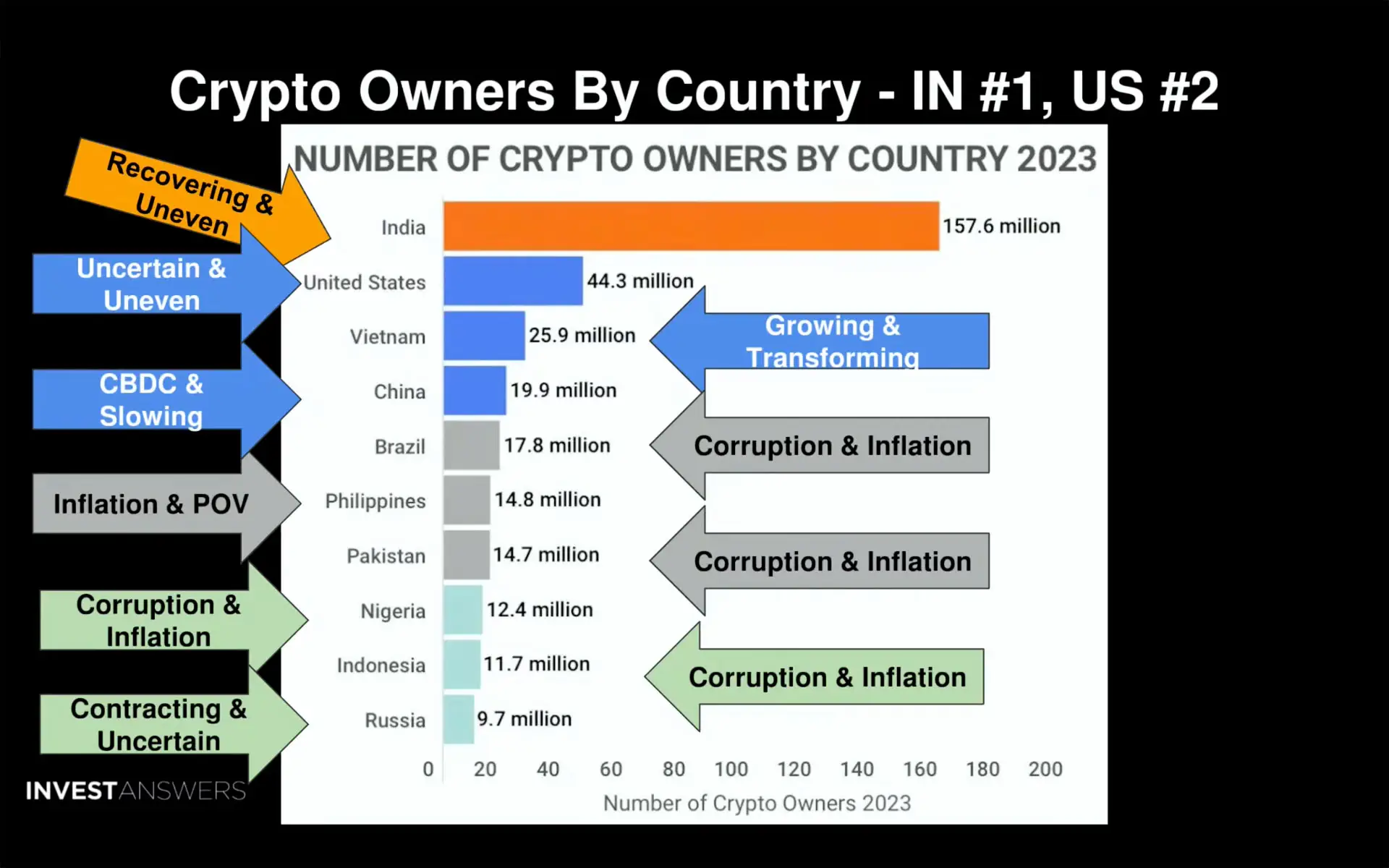

Digital Asset Ministries is a non-profit organizations that assists other non-profit organizations enhance donations by receiving digital assets as donations. Once received, digital assets can be immediately converted to cash for normal operations — or sent to affiliated organizations around the world for payroll or other expenses. The benefit of digital assets is that they can be transferred easily to other ministries without an intermediary such as a central bank or interfering government. All that is needed is an Internet connection and cell phone or computer. This is especially important for countries where many of its citizens are unbanked or have repressive governments that control the banking system. Digital Assets can also be retained in accounts as a store of value or for income generating purposes.

What Digital Assets to Consider for Donations

U.S. Dollar Stablecoin (USDC)

USDC is a digital asset with its value pegged to the U.S. Dollar. It is used in blockchain transactions when stability in value is the primary objective. Once received, USDC and be converted to local currency — or converted to other digital assets for income generation — or a store of value with appreciation potential.

Bitcoin (BTC)

Bitcoin may be used by a donor as a donation, but this generally depends on market value cycles. Because of its volatility in price, each donor may have different reasons and timing for their donations. For example, if price appreciation is anticipated, a donor may delay the donation to accumulate more value in the digital asset. Conversely, a donor may want to make a donation at the top of a market cycle to increase both the value of the donation and the tax write-off that may be associated with the donation. In any case, the non-profit organization may convert the Bitcoin to local currency — or retain the digital asset for appreciation or a store of value.

Ethereum (ETH)

Ethereum is similar to Bitcoin in that its value varies in market cycles. It is often referred to as an “Alt” Coin — or an alternative to Bitcoin. Ethereum is a token on its own blockchain which is totally different than the Bitcoin network. Moreover, it is based on a different method of transaction verification on its own blockchain as a distributed ledger. For reference, Bitcoin is a “Proof of Work” network whereas Ethereum is a “Proof of Stake” network. The differences between these two networks is beyond the scope of this newsletter, but the main thing to note is that you can “Stake” Ethereum owned to support the network and earn fees in doing so. Similar to Bitcoin, Ethereum can immediately be converted to local currency — or retained to produce income or an appreciation in value.

Market Analysis - Bitcoin

As you can see from the chart below Bitcoin is a volatile asset. It has been in a steady upward trend, however, since its inception in 2011. When accepting digital assets as donations, it is important to understand the cyclical nature of each asset and where we are in each cycle. As an example, the current price of Bitcoin is below the orange Mid Regression Line in the chart below. For the millions of investors that hold BTC in their digital asset portfolios, this is an “accumulation” period for Bitcoin. As such, digital asset donations may not be as active when BTC holders are in this accumulation phase. On the other hand, when the value of Bitcoin is approaching an all-time high, there may be an increase in digital asset donations because potential donors may be selling BTC at a profit and therefore be more liquid. If this were to occur, it would increase the likelihood of donations in either cash or digital assets.

At the present time, it is anticipated that the next all-time high for Bitcoin will occur in the next 12 to 18 months. This is important because it gives non-profit organizations time to consider their options and position themselves to receive digital asset donations. This would be done by setting up digital asset accounts and learning more about digital asset transactions in connection with local banks.

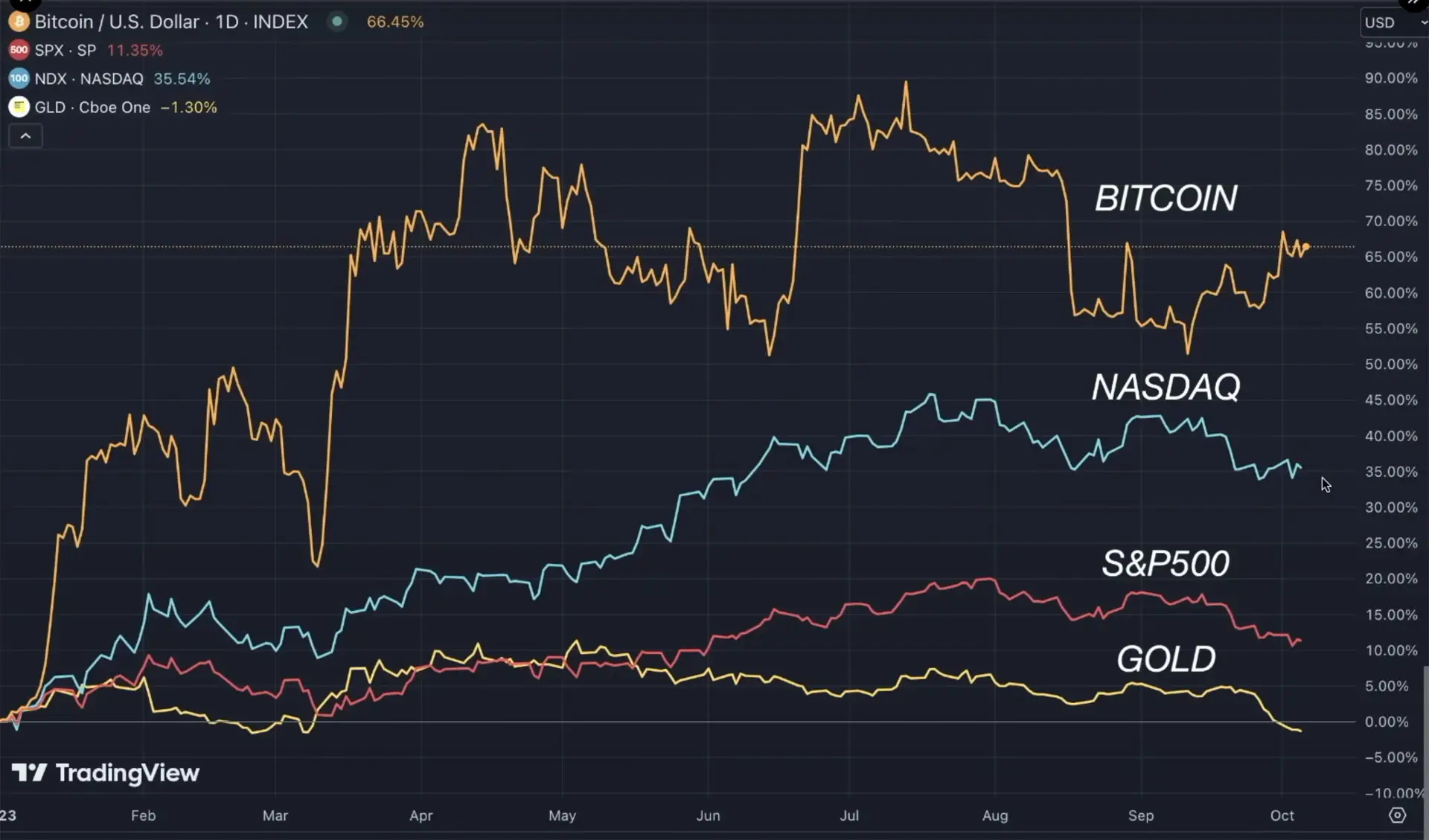

To keep things in perspective, we have added charts for the Nasdaq, S&P 500, and Gold returns to show comparisons in volatility and return on investment for these asset classes compared to Bitcoin. The sections below address why the price of Bitcoin may increase in value over the next 12 to 18 months. These reasons include: 1) Limited Supply; 2) Market Liquidity; 3) Government Spending; and 4) the Bitcoin Halving Event.

Limited Supply

In 2008, the original developers of the Bitcoin protocol set the cryptographic maximum number of Bitcoin to be mined at 21 Million coins. At the current time, a total of 19.52 Million BTC has been mined. It is widely thought, however, that around 5 Million coins have been lost over the last 14 years. This loss was caused by deaths of coin holders who did not provide for distribution of the coins upon death — or inexperienced Bitcoin holders who lost lost funds by not following the correct storage or transfer procedures. While this sounds daunting, the technology has improved so that the loss of coins has been drastically reduced, and in addition, there is much more documentation on how to follow the best procedures for security. All that being said, because of this Limited Supply, Bitcoin will become truly deflationary when all 21 Million Bitcoin have been mined.

Bitcoin Spot EFTs – Up until now, almost all investment in digital assets has been limited to the retail investor. This is mainly due to the lack of Rules & Regulations from the Securities and Exchange Commission (SEC). At the present time, however, large asset managers like Blackrock and Fidelity have made applications to the SEC to approve spot Bitcoin ETFs. Approval ie expected in the 4th quarter of 2023 or the 1st quarter of 2024. Once spot ETFs are approved by the SEC with accompanying regulations, it is anticipated the asset managers worldwide will then recommend to their clients to put a small percentage into this new digital asset class. If only 1% or 2% of institutional assets are brought into the Bitcoin market, it is anticipated that the limited supply of Bitcoin will drive the price upwards. Keep in mind that this includes IRA and pension funds that hold trillions in value competing for a portion of a limited supply of this new asset class.

Market Liquidity

Although Bitcoin is often referred to as “Digital Gold”, it is still considered a “Risk Asset”. BTC has been somewhat correlated to the Nasdaq in recent years, but that correlation is diminishing. In addition, many investors now think of Bitcoin as a “Flight to Safety”as evidenced by a sharp increase of new BTC addresses and digital wallets. At any rate, when the M2 money supply is low and there is not much “Liquidity” in the system, risk assets dotend to shift into a downtrend, or remain rangebound. Conversely, when there is a lot of liquidity in the market, risk assets tend to begin an uptrend and increase in value. Many market analysts predict that the “Fed” will start to reduce rates sometime in the upcoming year, and if this happens, it may begin a time of more Liquidity entering into the market do to quantitative easing. In turn, risk assets may experience an uptrend with a correlated increase in value.

Government Spending

Although government spending has been obscene, many analysts anticipate spending will increase durning an election year. And if this occurs, it will most likely increase Liquidity in the market. In turn, this could benefit risk assets. On another note, excess spending may cause people to seek safe assets such as Gold or Bitcoin. Both of these asset classes are considered a “Store of Value” and could see an increase in price as demand increases.

Bitcoin Halving

A Bitcoin Blockchain is a decentralized network of “Blocks” (validators) that verify all Bitcoin transactions on the network. This is often referred to as a “Distributed Ledger”. The process of building blocks in the network is called mining and it is done by Mining Companies, most of which are listed on the Nasdaq. These mining companies have warehouses of computers able to solve complicated math problems which are required before being “awarded” a new block in the blockchain. When done in this manner, the mining company currently receives 6.25 Bitcoin as the reward for solving the problem and winning the block. In April of 2024, however, the new block reward will be reduced to 3.125 Bitcoin. In essence, this reduces the available supply of Bitcoin and in theory increases the value of each Bitcoin.

Conclusion

Digital Asset adoption is advancing at an astonishing rate and non-profit organizations should consider receiving Digital Assets as donations. The primary objective would be to set up an internal system to convert digital assets to cash for local operations — or transfers to other operations. Secondary objectives should be directed to understanding the value and use-case for digital assets so they can be used for either income generation or a store of value of an appreciating asset.

* Last year, there were 98.5 million crypto users in European countries, up from 71.5 million a year before that. Statistics show Europe’s crypto user count is expected to jump by a massive 43% year-over-year and hit 141 million in 2023.

Contact Us

© 2022 All Rights Reserved.