This section demonstrates how to receive Digital Assets in a self-custody cold wallet or cryptocurrency exchange account. The dual focus will be in self-custody cold wallets and a typical cryptocurrency exchange. (Withdrawal of U.S. Dollars to a traditional bank account is discussed elsewhere in this website.)

- Self-Custody Cold Wallet

- Cryptocurrency Exchange or Brokerage Account

The most important thing to understand is the format of digital asset addresses as explained in a Google search: a Digital Asset Deposit Address is the public “address” issued to Customer; It is mathematically linked to the Digital Asset Private Key that represents a destination (or inbox) for a Digital Asset transfer.

Although each address is public for verification and recording purposes, all other information such as the account owner’s account name, etc is kept private. In some ways, the address is a simple form of ownership; i.e. you are the owner of that digital asset with that specific address maintained on that blockchain.

Receive Transactions

The most secure way to receive digital assets is to receive them in a personal self-custody cold wallet. The other option is to use a cryptocurrency exchange or brokerage account to receive digital assets. Typically, receiving digital assets appears in your account almost immediately. The “verification” process, however, may take up to 10 minutes. Once digital assets have been received in a secure self-custody wallet, they can then be stored for future use or transfer.

Self-Custody Wallet

This image is of the Ledger Nano X self-custody “cold wallet”. (See Send Digital Assets for use of the Trezor Model One.) The Ledger is only a few inches long and folds up easily for storage of digital asset keys. It connects to your computer by a USB cable and should only be connected to your PC when analyzing, sending, or receiving assets.

It is important to note that digital assets are not actually stored on the device. To the contrary, all digital assets in the account are stored on its associated blockchain. Thus, if you lose the wallet, or it is damaged, you can buy another wallet and activate it by using your secret key phrases and password.

A step-by-step process of “Receiving” Digital Assets is described further below.

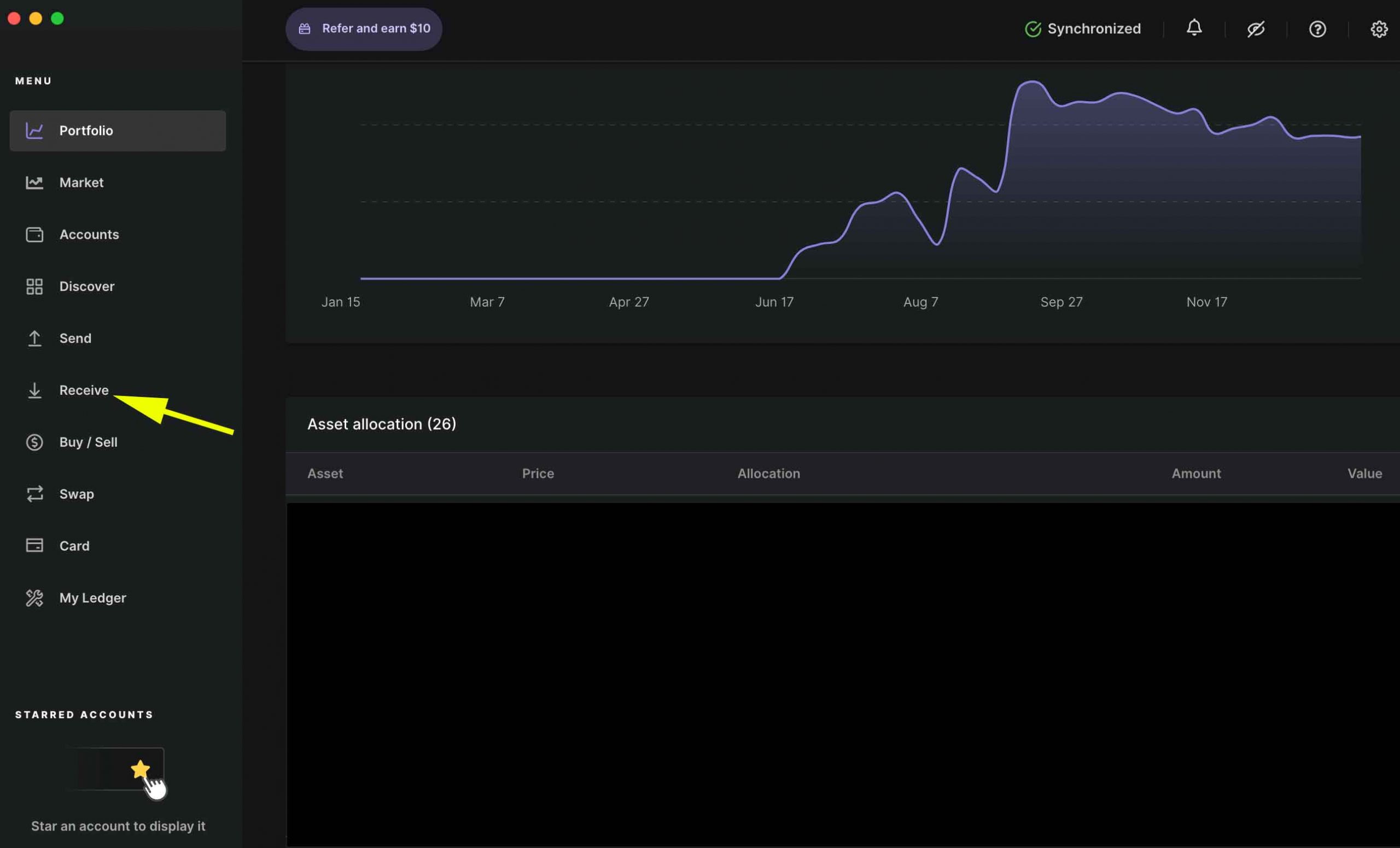

Ledger Live Dashboard

When you own a Ledger Cold Wallet, you also download the “Ledger Live” software that can be used on a mobile device or computer. This software allows an authorized user (with username and password) to view the assets currently held on account. For additional security, this software is also used to approve receiving or sending digital assets. This assures that no actionable event can take place without approval by the owner or administrator of that account.

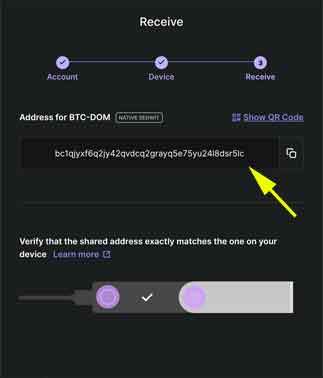

Receive Transaction

Once the digital asset to be deposited in the Ledger Account is selected, another dialog box will appear showing the address of that asset. At this time, there are two ways to get the address; 1) click on the double page icon to copy the address, or 2) take a shot of the code and use this in the mobile phone or computer application that you are using (if this feature is available).

There are two other things to note. First, you need to make sure that the “Network” you will be using refers to the digital asset (or coin) that is being deposited. Second, take not of the number of confirmations estimated on the blockchain. For reference, blockchain confirmations of the transaction may range between 1 and 20. This is all done for security verification purposes. In most cases, the transaction will appear in 2 to 3 minutes, but it could be up to 10 minutes depending on network traffic.

Brokerage or Exchange Deposits

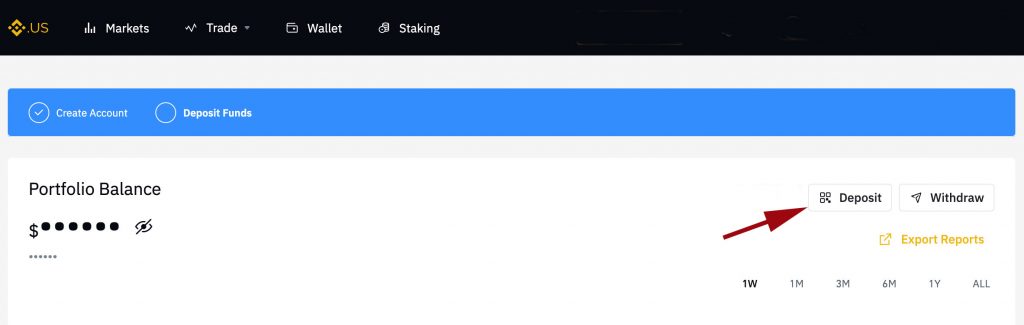

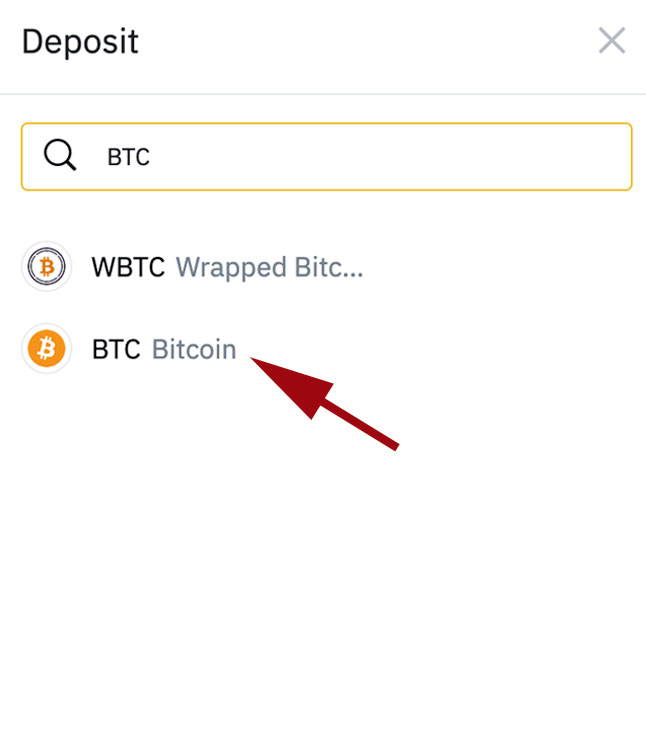

Rather than receive donations directly on a cold wallet such as Ledger or Trezor, donations can also be received in an online brokerage or cryptocurrency exchange account. If a donation does not need be converted to U.S. Dollars, which would then be transferred to a traditional bank account, we recommend sending the digital asset to the organization cold wallet(s). In the illustration below, we are using Binance to receive the digital asset donation. To gain access to the address to be sent to a donor (or posted on a website or newsletter) simply click on the “Deposit” button which is shown by the red arrow. This will take you to another screen.

Chokepoint 2.0

Please note that some traditional banks are threatened by cryptocurrency. The main reason is competition. In other words, many traditional banks are experiencing withdrawals of funds being transferred to cryptocurrency exchanges or brokerage accounts like Fidelity for investment purposes. Along the same lines, banks are threatened by withdrawals of funds from banks into higher-yielding money market funds.

Another threat to traditional banks is monthly fees and the cost of transferring money through the traditional banking system. For example, the cost of transferring digital assets is much cheaper and quicker than traditional banks. Moreover, there are “DeFi” (Decentralized Finance) protocols on many decentralized blockchains where lenders and borrowers can transact business directly and bypass the middleman banks. In DeFi cases, loan approval is determined between parties of each transaction on the blockchain — and not determined by some low level loan officer trying to follow bank policies.

So, make sure your local bank is crypto friendly — and allows frequent withdrawals and deposits to and from cryptocurrency exchanges or brokerage firms. If not, consider opening a separate account for cryptocurrency transactions at a crypto friendly bank.

© 2022 All Rights Reserved.