This section demonstrates how to send digital assets from a self-custody cold wallet or an online centralized cryptocurrency exchange. This typically done for the following reasons.

- Send Digital Asset to a Cryptocurrency Exchange for Conversion to U.S. Dollars.

- Send Digital Asset to a Cryptocurrency Exchange for Conversion to a Different Digital Asset.

- Send Digital Asset to Sister Organization for Asset Management or Distribution.

- Send Asset to Missionary Outreach for Asset Management or Distribution.

Sending Digital Assets from a Cold Wallet

Self-Custody Wallet

This image is of the Trezor Model One self-custody “cold wallet”. (See Receiving Digital Assets for use of the Ledger Nano X cold wallet.) The Trezor is only a few inches high and used for cold storage of digital assets. It connects to your computer by a USB cable and should only be connected to your PC when analyzing, sending, or receiving assets stored on the device. When not in use, the Trezor should be disconnected from the computer and stored in a safe place.

It is important to note that digital assets are not actually stored on the device, but instead, are stored on the blockchain. Thus, if you lose the wallet or it is damaged, you can buy another one and activate it by using your secret key phrases and password — kept in a safe location.

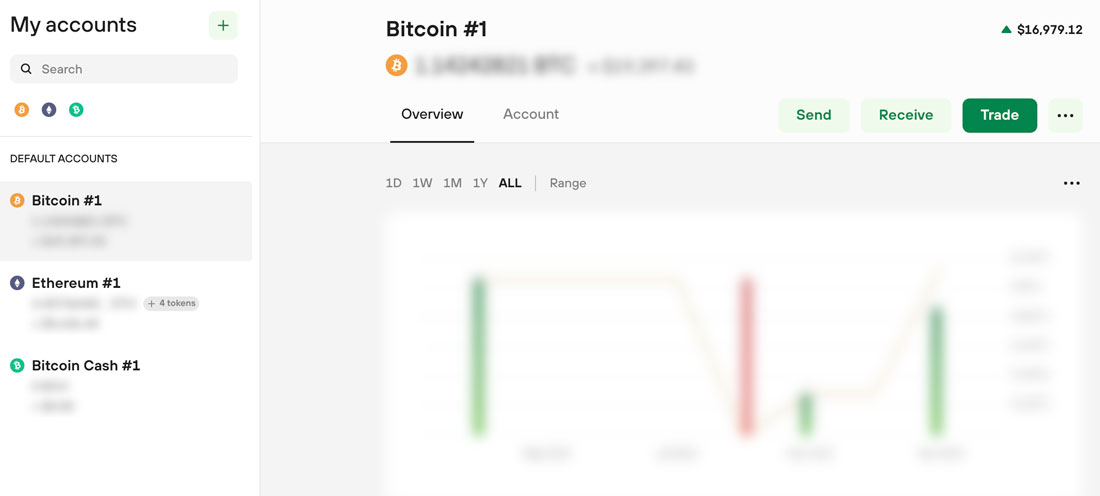

Trezor Dashboard

In the example above, there are 3 accounts: Bitcoin #1; Ethereum #1; and Bitcoin Cash #1. The accounts can be set up by office account or ministry, and as such, there may be multiple Bitcoin account that can be held on the Trezor device. You will note that the USDC Stablecoin does not appear at the account level because it is a “Token” inside the Ethereum #1 account. Again, the current price of Bitcoin is shown in the upper right hand corner of the screen ($16,979.12) on the date this webpage was created. Let’s see where this price is in the future. (Other information is intentionally blurred out.) To send a digital asset, the next thing you do is click on the “Send” Button.

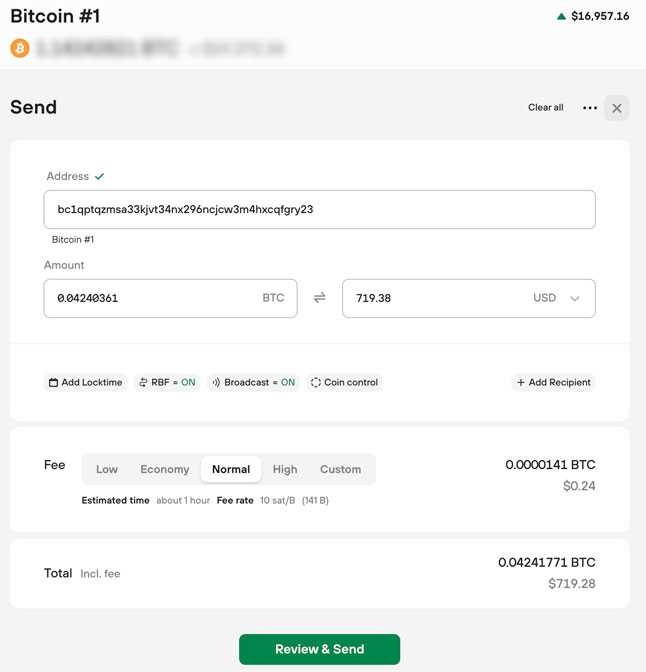

Send Transactions

This image contains a lot of information and appears when you click on the “Send” Button on the Accounts Page of your Trezor computer application page. At the top left, Bitcoin #1 represents the account on your Trezor device that hold the Bitcoin (BTC) that you would like to send. The “Address” is the address given to you, or the address you copied from the account, where the Bitcoin is to be sent. The “Amount” is the fractional share of the digital coin you would like to send. The “USD Equivalent” of that fractional amount based on the price of BTC and the time and date you are preparing to send. The “Transfer Fee” of $0.24 cents is the amount charged at that time for the transfer anywhere in the world.

A send transfer of this sort can occur any time of the day, seven days a week, and 365 days a year.

(The Blockchain never sleeps or closes its doors.)

Transaction History

Trezor Device Application – All transaction history is kept on the device application. Thus, it can always be pulled up and reviewed. This includes all deposits and send and receive transaction.

Income Tax Software – There are multiple software products that keep track of all cryptocurrency transactions for tax purposes. Most software packages include API features that allows the device software to be linked to the tax application software. When done in this manner, it’s a simple “Click” to refresh all data held on the device with all transactions being transferred to the tax software. At year-end, the tax software will allow you to download Form 8949, Schedule D, which can be very useful for tax accountants.

Digital Payment Systems

Digital payment systems are advancing rapidly. Many “Centralized” companies are moving towards Blockchain Technology — and more mobile app payment systems are being developed. Significant efforts are directed to the “unbanked” in many countries around the world. In fact, some countries have adopted Bitcoin as there national currency. Moreover, many countries do not have convenient banking facilities for local residents to use. Because of this, many countries are developing their Internet infrastructure so that remote residents can do all their financial transactions by simply using their mobile phones or computers. This is especially true for missions and ministries around the world who serve in remote area and financial support is not readily available. In the coming years, people will be using digital assets to buy everyday necessities. Thus, now is the time for non-profit organizations to develop their own digital infrastructure and services..

© 2022 All Rights Reserved.